Pay Your Bill

Simple. Easy. MyChart.

Through MyChart, you can pay your bill online with or without a MyChart account.

Benefits of creating a MyChart account

- Go paperless

- View your balance real-time

- View your statements online

- Save your payment methods

- View payment history

Need help? Download our guide to paying your bill with MyChart.

Did you receive a bill from one of our partnering providers? View more information here.

Patient Payment Options

All Major Payment Methods Accepted

- Cash

- Check

- Debit Card

- Money Order

- Visa

- MasterCard

- Discover

- American Express

Payment Plans

Short-term payment plans (up to 3 months) can be set up through Avita. Payments can be automated through your preferred card or bank account.

Long-term payment plans (up to 36 months) can be set up through our partner HELP Financial.

Financial Assistance Program

MyChart Paperless Billing

We’ve moved to paperless bills!

Paperless billing is more secure, convenient and eco-friendly. This move supports our commitment to minimizing health care costs and reducing our environmental footprint.

If you have a MyChart account, you’ll be notified of new billing statements through email and the MyChart mobile app. If you have selected to receive paper statements, this change will not affect you.

Managing Your Paperless Billing Settings

How to View Your Paperless Billing Statements

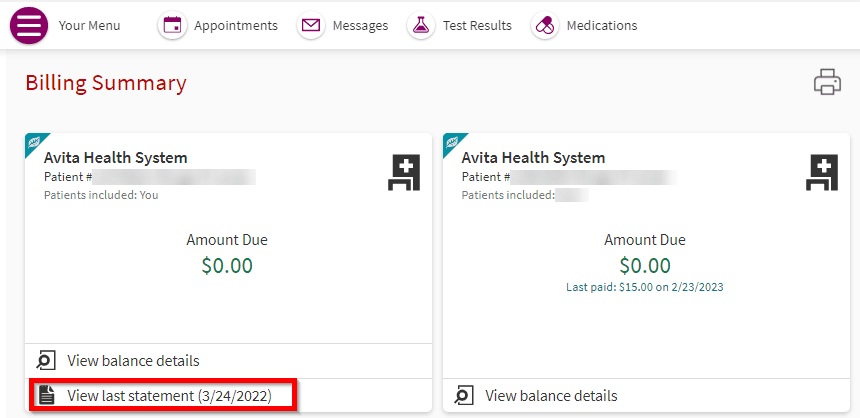

To see your paperless billing statements, log in to your account on MyChart, then go to Menu > Billing Summary > View last statement.

If you need a paper copy of your statement, you can print directly from MyChart.

Don’t forget: You can pay your bill online.

How to Opt Out of Paperless Billing

You can opt out of paperless billing at any time.

If you are enrolled in paperless billing and wish to opt out, follow these steps:

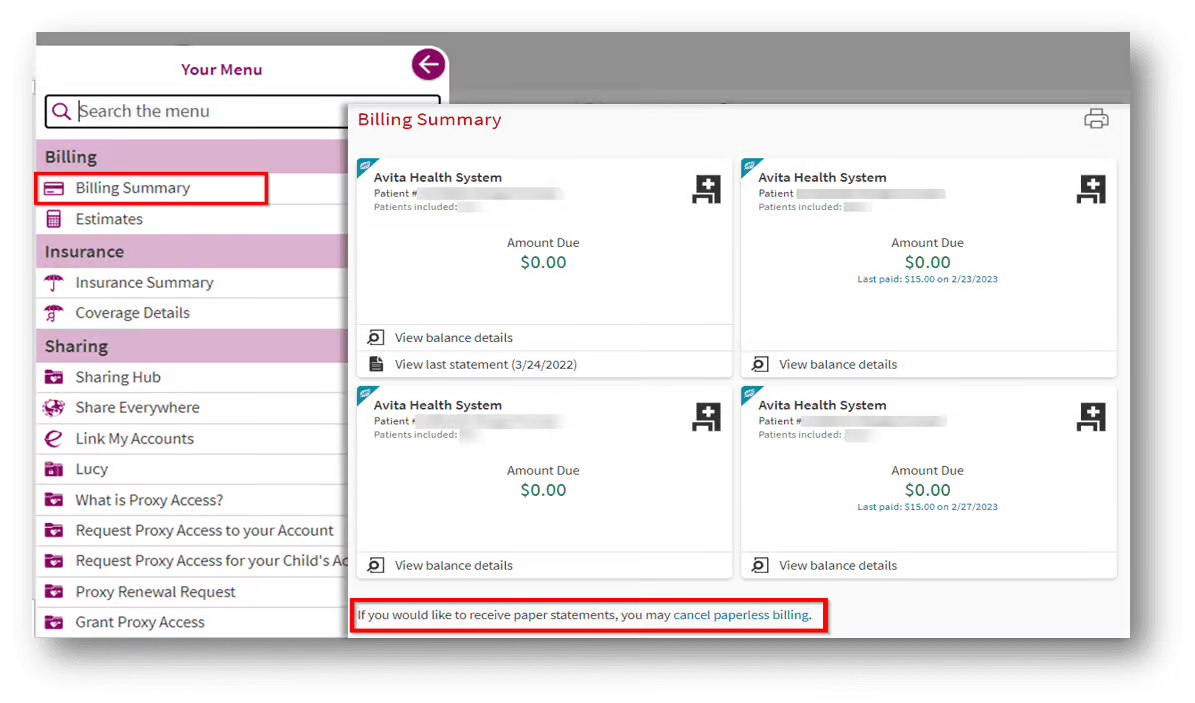

- On the homepage of your MyChart account, click the menu and select Billing Summary.

- Under your billing summary you’ll see a statement that reads “If you would like to receive paper statements, you may cancel paperless billing.” Click on the words “cancel paperless billing.“

- On the next screen, click the button “Receive paper statements.“

Frequently Asked Questions

What do you mean when you say you moved to paperless statements?

On June 7, 2022, patients with active MyChart accounts stopped receiving paper bills in the mail unless they opted out of paperless billing from within their MyChart account.

Why did you move to paperless billing for patients with active MyChart accounts?

At Avita Health System, we believe strongly in doing our part to reduce paper waste. To minimize the environmental impact of printing paper and costs associated with sending paper statements, we encourage our patients to go green. If patients still prefer paper statements, they can opt out and continue receiving paper bills.

What if I want to continue receiving paper statements?

We understand that some patients with MyChart accounts prefer to receive a paper statement — and that’s OK!

Receiving paper statements is easy. You’ll need to opt out of paperless billing statements, which can be done via your MyChart account on the MyChart website.

Patients can opt in and opt out of receiving paper statements as often as they would like.

I don’t have a MyChart account. Does this change impact me?

No. Patients who don’t have a MyChart account will receive paper statements. If you don’t have a MyChart account, we encourage you to sign up to experience the many benefits MyChart has to offer.

How will I know if I have a bill due if I don’t get a statement in the mail?

When a new statement is ready to review, you’ll receive a monthly notification to the email address on file in your MyChart account.

I have a payment plan established and my payment is automatically charged to my credit/debit card each month. Will I be required to view my billing statement each month to avoid receiving paper statements?

No, if your auto-payment plan remains current, you aren’t required to view your statement each month. However, if a new balance becomes due that isn’t on your payment plan, we’ll send you a courtesy paper statement if you haven’t viewed your billing statement in MyChart.

As a reminder, you can self-service your payment plan to add new balances or change payment terms from within your MyChart account.

Why is my balance due in MyChart different than the amount on my billing statement?

Billing statements are generated on a monthly cycle and are only current as of the date of the statement. Balances displayed in MyChart, however, are updated in real time and will show any current unpaid balance.

I need help in opting out of paperless billing. Is there someone I can call for assistance?

Yes, our customer service team can assist you with any questions related to paperless billing or opting out.

Call 1-833-462-8428 or 419-468-0512, or send a billing message to our customer service team from your MyChart account.

Personalized Estimates

Avita Health System is committed to offering fair and competitive prices to our patients. The amount you will owe depends on many factors, including the services rendered and your insurance plan.

When you have scheduled or outpatient services at Avita, a representative will provide you with an estimate of what you are expected to owe for services based on your plan benefits. We will discuss payment arrangements with you to inform you of Avita’s generous financial options.

Self-Service Patient Estimates

Create a personalized estimate that will quote your estimated costs for services based on your plan benefits.

Contact Us for an Estimate

Avita can generate your estimate prior to services. Contact us today for your free personalized estimate:

- Contact our Customer Service team:

- Call us at 419-468-0512 (toll free 1-833-462-8428) Monday thru Friday 8:00am – 4:30pm

Financial Aid

Avita is committed to providing access to health care for everyone regardless of their ability to pay. We commit to do so in a professional and compassionate manner that respects our patients’ dignity and privacy.

Resources to Help Pay Your Healthcare Costs

Avita Financial Counselors can assist you with applying for:

- Medicaid

- The Marketplace

- 3-36 Month Payment Plans

- Financial Assistance

Avita’s Financial Assistance Program

The Avita Financial Assistance Program is designed to provide fair and consistent access for all patients and is available for qualified patients. Financial Assistance for qualified patients may be applied to any Avita bill.

Financial Assistance includes:

- Free care for individuals and families who earn less than 200% of the federal poverty level

- Sliding scale of discounted care for individuals and families who are between 200% and 400% of the federal poverty level

- Medical hardship assistance for families who would not otherwise qualify for financial assistance but have unique circumstances

Completed and signed applications may be returned, along with supporting documents, via any of these means:

- MyChart – Click Your Menu > Billing > Financial Assistance

- Online Application

- Mail –

Patient Service

700 N Columbus St

Crestline, OH 44827 - Fax – 419-462-4582

- In Person – At any Avita Hospital

Additional Information:

Pricing Information

Avita Health System is committed to offering fair and competitive prices to our patients. Our commitment to price transparency helps ensure you have the information you need. The amount you will owe depends on many factors, including the services rendered and your insurance plan.

Below is pricing information for Avita hospital services. Please remember that while hospital charges are the same for all patients, your patient responsibility may vary based on many factors. These lists are not helpful tools for patients to comparison shop between hospitals or to estimate what health care services are going to cost them out of their own pocket.

Click here for information on Patient Protections Against Surprise Billing.

Standard Charges

Avita has negotiated in-network discounts with many insurance plans. This discount is often reflected on your explanation of benefits and statement as a contractual allowance. See How Medical Insurance Works for more information.

To provide you with further pricing transparency and to help you understand hospital charges and negotiated rates, Avita provides a price list of standard charges for each hospital in our health system.

These lists do not reflect the amount you will owe, which depends on many factors including your plan benefits.

- For an estimate of what you will owe based on your plan benefits, see Personalized Estimates below.

Personalized Estimates

You can also create a personalized estimate that will quote what you are expected to owe for services based on your plan benefits.

Common Charges

Below are standard charges for common hospital services as of 07/01/2025. Please remember that this does not reflect payer-negotiated rates, patient benefits or available discounts.

Outpatient Labs

| Lab Test | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Venipuncture – This is charged for labs collected via blood draw | 36415 | $7.00 |

| ALT (SGPT) | 84460 | $21.00 |

| Amylase | 82150 | $91.00 |

| APTT | 85730 | $78.00 |

| AST (SGOT) | 84450 | $21.00 |

| Basic Metabolic Panel | 80048 | $28.00 |

| Calcium | 82310 | $49.00 |

| CBC & Platelet with Differential | 85025 | $29.00 |

| Comprehensive Metabolic Panel | 80053 | $42.00 |

| COVID-19 | 87635 | $150.00 |

| COVID-19 Antibody | 86769 | $55.00 |

| Creatinine | 82565 | $21.00 |

| Glucose | 82947 | $17.00 |

| Hemoglobin | 85018 | $44.00 |

| Hemoglobin A1C | 83036 | $38.00 |

| Hepatic Panel | 80076 | $24.00 |

| Lipid Panel | 80061 | $47.00 |

| Magnesium | 83735 | $82.00 |

| Myoglobin | 83874 | $186.00 |

| Phosphorus | 84100 | $78.00 |

| Potassium | 84132 | $36.00 |

| Prothrombin Time | 85610 | $17.00 |

| PSA | 84153 | $40.00 |

| Sedimentation Rate | 85651 | $62.00 |

| Sensitivity Study | 87186 | $32.00 |

| Sodium | 84295 | $32.00 |

| Thyroid Stimulating Hormone | 84443 | $65.00 |

| Thyroxine, Free T4 | 84439 | $84.00 |

| Troponin | 84484 | $168.00 |

| Urinalysis with Microscope | 81001 | $15.00 |

| Urine Culture with Colony | 87086 | $30.00 |

| Urine Culture with Organism ID | 87088 | $46.00 |

Outpatient Imaging

The following charges reflect the most common outpatient imaging services. Patients may have different or additional charges, depending on the services performed and the contrast administered. Fees for the Radiologist provider will be billed separately.

CT and MRI Charges

| Imaging Test | CPT | Charge Before Insurance or Discount |

|---|---|---|

| CT Abdomen with Contrast | 74160 | $5,486.00 |

| CT Abdomen with & without Contrast | 74170 | $5,590.00 |

| CT Chest with Contrast (Thorax) | 71260 | $3,558.00 |

| CT Head with & without Contrast | 70470 | $3,207.00 |

| CT Head without Contrast | 70450 | $1,978.00 |

| CT Pelvis with Contrast | 72193 | $4,322.00 |

| MRI Brain with & without Contrast | 70553 | $4,988.00 |

| MRI Lumbar Spine without Contrast | 72148 | $4,713.00 |

X-Ray (XR) Charges

| Imaging Test | CPT | Charge Before Insurance or Discount |

|---|---|---|

| XR Abdomen (KUB) | 74018 | $476.00 |

| XR Acute Abdominal Series | 74022 | $649.00 |

| XR Ankle | 73610 | $453.00 |

| XR Chest – Portable | 71045 | $324.00 |

| XR Chest 2 views (PA & Lateral) | 71046 | $339.00 |

| XR Foot | 73630 | $454.00 |

| XR Hand/Fingers | 73140 | $343.00 |

| XR Hip and Pelvis | 73502 | $362.00 |

| XR Knee | 73560 | $406.00 |

| XR Lumbar Spine 2 views (PA & Lateral) | 72100 | $593.00 |

| XR Pelvis | 72170 | $309.00 |

| XR Shoulder | 73020 | $453.00 |

| XR Wrist | 73100 | $368.00 |

Other Imaging Charges

| Imaging Test | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Bone Density Scan (Dexa) | 77080 | $580.00 |

| 3D Mammogram, Diagnostic Unilateral | Includes 2 codes | $713.00 |

| 3D Mammogram, Diagnostic Bilateral | Includes 2 codes | $892.00 |

| 3D Mammogram, Screening | Includes 2 codes | $326.00 |

| Modified Barium Swallow | Includes 2 tests | $1,070.00 |

| Thyroid Uptake and Scan | 78014 | $3,849.00 |

| Ultrasound Abdomen Complete | 76700 | $1,277.00 |

| Ultrasound Carotid Duplex Bilateral | 93880 | $973.00 |

| Ultrasound Extremity Non Vascular | 76881 | $566.00 |

| Ultrasound Gallbladder | 76705 | $928.00 |

Outpatient Therapy

The following charges reflect the most common outpatient therapy services offered. Patients may have additional charges, depending on the services performed.

Physical Therapy

| Therapy | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Evaluation – Moderate Complexity | 97162 | $410.00 |

| Electrical Stimulation | 97032 | $168.00 |

| Gait Training – 15 minutes each | 97116 | $128.00 |

| Manual Therapy – 15 minutes each | 97140 | $234.00 |

| Therapeutic Activity – 15 minutes each | 97530 | $137.00 |

| Therapeutic Exercise – 15 minutes each | 97110 | $148.00 |

| Ultrasound | 97035 | $177.00 |

Occupational Therapy

| Therapy | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Evaluation – Moderate Complexity | 97166 | $410.00 |

| Therapeutic Activity – 15 minutes each | 97530 | $137.00 |

| Therapeutic Exercise – 15 minutes each | 97110 | $148.00 |

Outpatient Cardiopulmonary and Neurology Services

The following charges reflect the most common outpatient cardiopulmonary and neurology tests. Patients may have different or additional charges, depending on the services performed. Fees for the provider or interpretation are billed separately.

Stress Tests

| Cardiopulmonary Service | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Echo Complete with Doppler | 93306 | $1,925.00 |

| Stress Test – Treadmill with EKG | 93017 | $1,487.00 |

| Stress Test – Treadmill with Echo | Includes 2 tests | $5,003.00 |

| Stress Test – All Cardiolites | Includes 2 tests | $7,472.00 |

Diagnostic Testing

| Cardiopulmonary Service | CPT | Charge Before Insurance or Discount |

|---|---|---|

| EKG 12-Lead | 93005 | $195.00 |

| Holter Monitor – 24-48 hours | Includes 2 services | $1,069.00 |

| Holter Monitor – 48 hours to 7 days | Includes 2 services | $1,408.00 |

| Pulmonary Function Study | Includes 3 tests | $1,871.00 |

EEGs/EMGs

| Neurology Service | CPT | Charge Before Insurance or Discount |

|---|---|---|

| EMG One Extremity | Includes 2 tests | $905.00 |

| EMG Two Extremities | Includes 3 tests | $1,501.00 |

| EEG – Up to 60 minutes | 95816 | $1,124.00 |

Avita Walk-in Clinics

Avita has two Walk-In Clinics located in Bellville and Ontario to provide convenient, fast treatment for injuries and conditions that are not critical, but need prompt attention. For more information, visit our walk-in clinic page.

Walk-In Clinic charges are based on the level of care needed to treat our patients (with Level 1 representing basic urgent care). The following charges do not include fees for drugs, supplies, or additional services provided during treatment.

| Level of Care | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Level 1 | 99211 | $115.00 |

| Level 2 | 99212 | $163.00 |

| Level 3 | 99213 | $221.00 |

| Level 4 | 99214 | $241.00 |

| Level 5 | 99215 | $324.00 |

Emergency Services

Avita has three Emergency Departments located in Ontario, Galion, and Bucyrus. Visit our locations page for directions.

Emergency Department charges are based on the level of emergency care needed to treat our patients (with Level 1 representing basic emergency care). The following charges do not include fees for drugs, supplies, or additional services provided during treatment. These also only reflect the Hospital level charges and do not include fees for the Emergency Department physicians, which is billed separately.

| Level of Care | CPT | Charge Before Insurance or Discount |

|---|---|---|

| Level 1 | 99281 | $259.00 |

| Level 2 | 99282 | $453.00 |

| Level 3 | 99283 | $639.00 |

| Level 4 | 99284 | $1,023.00 |

| Level 5 | 99285 | $1,527.00 |

Room Charges

Room and Board charges reflect the type of care needed to provide treatment. Operating Room charges are based on the level of care needed to treat our patients (with Level 1 representing basic care). The following charges do not include fees for drugs, supplies, or additional services provided during treatment. These also only reflect the Hospital level charges and do not include fees for the physicians, which is billed separately.

Room and Board – per day

| Room Charge | Charge Before Insurance or Discount |

|---|---|

| Routine Care | $942.00 |

| Intensive Care (ICU) | $1,962.00 |

| Labor & Delivery (Obstetrics) | $942.00 |

| Nursery | $942.00 |

| Inpatient Rehab | $1,195.00 |

| Swingbed | $705.00 |

Operating Room – up to 30 minutes

| Room Charge | Charge Before Insurance or Discount |

|---|---|

| Level 1 | $3,297.00 |

| Level 2 | $3,749.00 |

| Level 3 | $4,079.00 |

| Level 4 | $4,576.00 |

| Level 5 | $5,017.00 |

Financial Clarity for Patients

What is Financial Clarity?

Financial Clarity is a process designed to help you understand your financial responsibilities before undergoing elective surgery or other scheduled medical services. This process involves:

- Providing you a cost estimate in advance.

- Educating you on your coverage and estimated out-of-pocket expenses.

- Offering information on payment options and financial assistance programs.

Our goal is to ensure you are well-informed about your financial obligations and have the necessary resources to manage them effectively.

How Payments Work

Understanding how payments work can ease your financial planning and ensure a smoother experience for scheduled, non-emergent services. Here’s what you need to know:

- Insurance Verification: If you have insurance, a Patient Financial Services Representative (PFS Representative) will verify your benefits to determine any financial responsibility you may have.

- Cost Estimation: For non-emergent services, we’ll provide an estimate of your financial liability. This includes what your insurance will cover and what you’ll need to pay out-of-pocket.

- Payment Collection: Estimated patient liabilities will be collected, or an approved payment arrangement will be initiated prior to the time of service.

- Payment Options: We accept all major payment methods. Options include payment in full, a 3-month internal payment plan, or an extended payment plan through our partner, HELP Financial.

- Payment Alternatives: If you cannot pay the estimated amount upfront or with one of our payment options, we will explore options like Medicaid coverage, Health Insurance Exchange enrollment, pharmacy assistance programs, and COBRA coverage.

When Payment is Expected

Payment expectations are defined to help you plan accordingly for scheduled, non-emergent services:

- Before Services: Payments or approved payment arrangements will be made at least two business days before the service.

- At the Time of Service: If payment arrangements haven’t been made beforehand, payment will be expected at the time of service.

- Payment Plans: If you’re unable to pay the full amount upfront, we offer payment plans. Our PFS Representatives will work with you to find a plan that fits your budget.

Emergency Room Services

At Avita Health System, your health and safety are our top priorities, especially in emergency situations. Here’s what you need to know about financial responsibilities related to emergency room (ER) services:

- Immediate Care: In the event of a medical emergency, our primary focus is on providing the necessary medical care immediately. No financial discussions or clearance are required before you receive treatment.

- Post-Stabilization: Once you are stabilized, if follow-up care is required, you will be referred to a PFS Representative. They will guide you through the financial clarity process for any subsequent non-emergent services you may need.

- Financial Assistance: Our financial assistance policies are available to all patients, including those who receive emergency care. If you qualify, you can receive aid to help cover your medical expenses.

Emergency services at Avita are provided without delay, ensuring that all financial matters are addressed only after your immediate health needs are met. Your well-being is our utmost concern, and we strive to ensure that financial concerns do not impede your access to essential emergency care.

FAQ

How will I know what my financial responsibility is?

A PFS Representative will provide you with a detailed estimate of your financial responsibility based on your insurance coverage and the scheduled services. This will help you prepare and arrange for payment in advance.

What if I don’t have insurance?

Patients without insurance will be classified as uninsured/non-covered and will be required to make payment arrangements before receiving elective services.

What if my insurance doesn’t cover the scheduled service?

If your insurance doesn’t cover the scheduled service, you’ll be informed and required to sign an Advance Beneficiary Notice of Non-Coverage (ABN) or waiver, and payment will be arranged according to our policy.

What happens if I can’t pay the estimated amount?

If you can’t pay the estimated amount, our PFS Representatives will screen you for applicable programs like Medicaid, Health Insurance Exchange enrollment, or pharmacy assistance programs. If you’re still unable to pay, non-emergent services may be deferred until a payment solution is secured.

How do I apply for financial assistance?

To apply for financial assistance, you can obtain an application from any Avita facility, visit our public website, or apply through MyChart.

What if I need urgent medical attention?

If you need urgent or emergent medical attention, services will not be delayed due to financial clarity. You’ll receive the necessary care, and financial discussions will take place once you are stable.

Have More Questions?

For more detailed information or to discuss your specific situation, please contact our Patient Financial Services Team anytime via MyChart or by phone at 419-468-0512, Monday thru Friday, 8:00am-4:30pm

Customer Service

Contact our Avita Customer Service team if you have questions about:

- Your Bill

- Payment Options

- Avita’s Financial Assistance Program

- Need help applying for Medicaid

- Need help applying for the Marketplace

- Would like a Personalized Estimate

Customer Service can be reached at:

419-468-0512

Toll free: 1-833-462-8428

OR

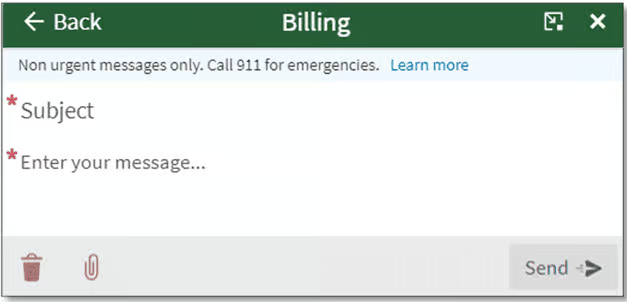

Contact Avita Customer Service regarding your bill via a secure message (with attachments, if applicable).

To send a message from the home page:

- Click Messages

- Click Send a message

- Click View your Billing Summary

- Click View balance details

- Click Contact customer service

Did you receive a bill from one of our partnering providers? View more information here.

Partnering Providers

Avita partners with other providers to ensure patients receive the highest quality care. While nearly all Avita services will be on a single billing statement, patients may receive more than one bill for some services. One bill will be from the hospital for the facility charge. You may also receive a bill from the independent provider(s) who interprets test(s) results. This is most common for imaging services, preadmission testing, surgery, and emergency services.

For example, when you get an x-ray, there is a claim from the hospital for the facility charge and a claim from the Radiologist for interpreting the test. As another example, if you were transported by ambulance or helicopter, you may receive a separate bill from the medical transport company.

Disclaimer: Please be aware that the providers listed below who perform these additional services are not necessarily in your insurance network. When in doubt, please contact either the provider or your insurance company.

These are some of the providers with whom Avita partners:

| Service(s) | Provider | Billing Phone |

|---|---|---|

| Device Monitoring | Bardy Diagnostics Boston Scientific | 844-341-1491 866-484-3268 |

| Interventional Cardiology | Owais Khawaja, MD | 419-294-4991 |

| Orthopedic Surgery | Orthopaedic Institute of Ohio (Steven Copeland, MD) | 419-222-6622 x5050 |

| Outside Pathologist | NeoGenomics | 949-362-7307 |

| Pain Management | Pain Management Group (Syed Ali, MD; Ju Gao, MD; Arjun Sharma, MD; Anna Gantz, CNP; Caroline Holden, CNP; Michaela Kindell, CNP) | 866-776-8150 |

| Podiatric Surgery | Kevin McGarvey, DPM | 419-342-6351 |

| Radiologist | Riverside Radiology and Interventional Associates | 866-863-6739 |

| Spine and Neurosurgery | Key Clinics, LLC (Joel Siegal, MD; Jessica Gray, CNP) | 216-916-7771 |

| Vascular | Galion Vascular Associates (Barry Zadeh, MD, FACC, FACS) | 877-668-1155 |

If you don’t see the provider listed above, please contact them at the number on your bill. For questions about your Avita bill, please contact our Customer Service team.

How Medical Insurance Works

Avita Health System is committed to offering fair and competitive prices to our patients. How much you will owe depends on many factors, including the services rendered and your insurance plan. This is why we’ve created a personalized estimate tool that will quote what you are expected to owe for services based on your plan benefits.

Avita has negotiated in-network discounts with many insurance plans. This discount is often reflected on your explanation of benefits and statement as a contractual allowance.

- Example: Avita agrees to a 5% in-network discount. This reduces a $100 charge to $95.

From the negotiated charge amount, the insurance pays according to your benefit plan. You will owe any applicable co-pays, co-insurance or remaining deductible until your out-of-pocket maximum is met.

Definitions

Co-pay – The fixed amount you pay at time of visit.

Co-insurance – The percentage of the covered amount that your insurance requires you to pay. For example, if you have an 80/20 plan, you owe 20% of the negotiated charge amount and insurance pays 80%.

Deductible – The amount you have to pay each year before your plan starts paying benefits. After you meet your deductible, you will continue to owe any co-pays and co-insurance amounts.

Out-of-pocket maximum – The amount your insurance company requires you to satisfy before you are no longer subject to co-insurance.

Examples

What Your Co-pay Might Look Like

In this example, if you visit an in-network doctor and your office visit was $200, you would pay a $25 co-pay and your plan would pay the remaining $175. The amount you pay for your co-pay will vary based on your plan.

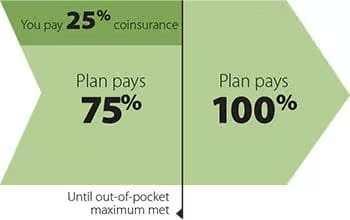

What Your Co-insurance Plan (No Deductible) Might Look Like

This example shows what your payments would look like if your plan had a 75/25 co-insurance plan with no deductible. Your plan would pay 75% of your bill until your out-of-pocket maximum was met. Then, your plan would cover 100% of the cost.

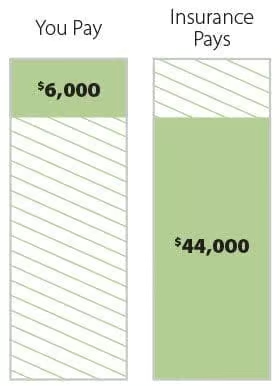

What Your Inpatient Costs Might Look Like on a Deductible and Co-insurance Plan

Let’s assume you have a health plan with a $1,000 deductible, 20% coinsurance, and a $6,000 out-of-pocket maximum. If you incur $50,000 in medical charges, you would first need to pay your $1,000 deductible. While 20% coinsurance of the remaining charges is $9,800, you would only owe $5,000 because this would meet your $6,000 out-of-pocket maximum for the year. That means, for the total $50,000 medical charges, you would owe $6,000 and your insurer would pay $44,000.

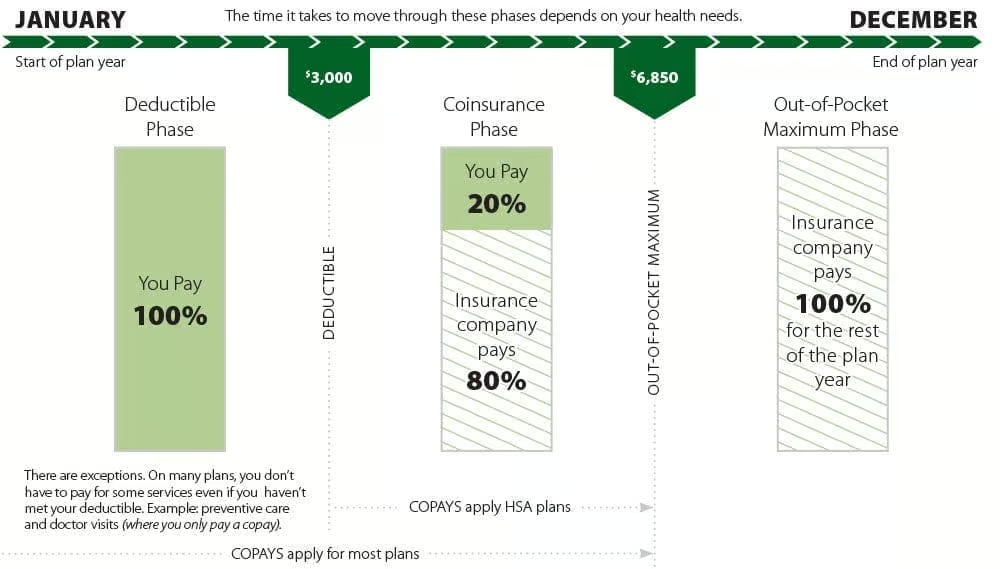

What Your Year Might Look Like for a $3,000 Deductible and 20% Co-insurance Plan

Your Rights and Protection Against Surprise Medical Bills

When you get emergency care or are treated by an out-of-network provider at an in-network hospital or ambulatory surgical center, you are protected from balance billing. In these cases, you shouldn’t be charged more than your plan’s copayments, coinsurance and/or deductible.

Insured Patients

What is “Balance Billing” (Sometimes Called “Surprise Billing”)?

When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, like a copayment, coinsurance, or deductible. You may have additional costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network.

“Out-of-network” means providers and facilities that haven’t signed a contract with your health plan to provide services. Out-of-network providers may be allowed to bill you for the difference between what your plan pays and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your plan’s deductible or annual out-of-pocket limit.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider. Surprise medical bills could cost thousands of dollars depending on the procedure or service.

You are protected from balance billing for:

Emergency services

If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most they can bill you is your plan’s in-network cost-sharing amount (such as copayments, coinsurance, and deductibles). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center

When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers can bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t

balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other types of services at these in-network facilities, out-of-network providers can’t balance bill you, unless you give written consent and give up your protections.

You’re never required to give up your protections from balance billing. You also aren’t required to get out-of-network care. You can choose a provider or facility in your plan’s network.

When balance billing isn’t allowed, you also have the following protections:

- You’re only responsible for paying your share of the cost (like the copayments, coinsurance, and deductible that you would pay if the provider or facility was in-network). Your health plan will pay any additional costs to out-of-network providers and facilities directly.

- Generally, your health plan must:

- Cover emergency services without requiring you to get approval for services in advance (also known as “prior authorization”).

- Cover emergency services by out-of-network providers.

- Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits.

- Count any amount you pay for emergency services or out-of-network services toward your in-network deductible and out-of-pocket limit.

Ohioans who get health insurance through plans regulated by the Ohio Department of Insurance are also protected from receiving surprise medical bills under Ohio law. Ohio law provides the following protections when you receive unanticipated out-of-network care:

- No balance billing for emergency services, including emergency services provided by an ambulance, even if they’re provided out-of-network.

- No balance billing by out-of-network providers at an in-network facility when you’re unable to choose an in-network provider.

- Your cost-sharing amounts, such as copayments, coinsurance, and deductibles, are limited to the amount you would pay for in-network services.

Health plans regulated by the state of Ohio should have the letters “ODI” clearly denoted on your insurance identification card. You can find additional information at Surprise Billing | Department of Insurance (https://insurance.ohio.gov/strategic-initiatives/surprise-billing).

If you think you’ve been wrongly billed, contact the Departments of Health and Human Services, Labor, and Treasury at 1-800-985-3059

Visit https://www.cms.gov/nosurprises/consumers for more information about your rights under federal law.

Visit https://insurance.ohio.gov/wps/portal/gov/odi/home for more information about your rights under Ohio laws.

Download a printable version of the insured patient information

Self-Pay Patients

You Have the Right to Receive a “Good Faith Estimate” Explaining How Much Your Health Care Will Cost

Under the law, health care providers need to give patients who don’t have certain types of health care coverage or who are not using certain types of health care coverage an estimate of their bill for health care items and services before those items or services are provided.

- You have the right to receive a Good Faith Estimate for the total expected cost of any health care items or services upon request or when scheduling such items or services. This includes related costs like medical tests, prescription drugs, equipment, and hospital fees.

- If you schedule a health care item or service at least 3 business days in advance, make sure your health care provider or facility gives you a Good Faith Estimate in writing within 1 business day after scheduling. If you schedule a health care item or service at least 10 business days in advance, make sure your health care provider or facility gives you a Good Faith Estimate in writing within 3 business days after scheduling. You can also ask any health care provider or facility for a Good Faith Estimate before you schedule an item or service. If you do, make sure the health care provider or facility gives you a Good Faith Estimate in writing within 3 business days after you ask.

- If you receive a bill that is at least $400 more for any provider or facility than your Good Faith Estimate from that provider or facility, you can dispute the bill.

For questions or more information about your right to a Good Faith Estimate, visit www.cms.gov/nosurprises/consumers, email FederalPPDRQuestions@cms.hhs.gov, or call 1-800-985-3059

Download a printable version of the self-pay patient information